Key findings on accelerating carbon-neutral energy transition

From 21 to 24 November 2023 the 23rd IERE General Meeting and Singapore Forum, co-hosted by Engie, took place in Singapore. Its main topic was "Accelerating the Carbon-Neutral Energy Transition for Industry and Territories". Pieter Jan Jordaens, Sirris expert in energy transition, was present, both as a speaker, to share test and demonstrations experiences set up in Belgium, and as a participant, to learn from industrials and academics from all over the world which emerging technologies are contributing to the energy transition.

At the start of the conference, Jan Mertens, Chief Science Officer at ENGIE Research, stated the purpose and goals of the IERE meetings: “We are here to accelerate the energy transitions, learn from each other and share experiences and results that are critical to accelerate the adoption of non-mature technologies, just as we did with photovoltaics and wind.”

Our expert Pieter Jan Jordaens highlights some of the most interesting findings relevant to learn from in respect to market opportunities abroad and as an inspiration for our own regions, which we bundled in a series of articles. The first article gives you a short overview of the key takeaways, obtained during the conference in general and specifically from keynote speakers Jan Mertens (Engie Chief Science Officer, Engie Research), Jan Holms (Board member, Seaborg), Thomas Baudlot (CEO Energy Solutions, Engie South East Asia), Fiona Buckley (Senior Expert and Senior Project Manager, Engie Laborelec), Jean-Pierre Keustermans (Research Partnership Manager, Engie Laborelec).

Necessary transition

Despite the increasing complexity and unpredictability of global political and economic conditions, it is imperative to expedite our journey toward carbon neutrality. Renewable energy technologies stand as pivotal elements in this pursuit. The shift in energy is a crucial step towards achieving net-zero carbon emissions by the latter half of this century. Central to this transition is the imperative to eradicate and diminish CO2 emissions originating from energy sources to mitigate the impacts of climate change. Leveraging renewable energy and implementing energy efficiency measures holds the potential to accomplish up to 90 % of the necessary carbon reductions.

However, not every country enjoys the same advantages when it comes to available renewable resources. Take Belgium, for instance, which boasts substantial offshore wind resources, making offshore electricity a significant component of its energy blend. We can consider ourselves lucky, in fact, when it comes to available renewable resource options, compared to Singapore for example which lacks good wind resources and does not have geothermal possibilities either.

Challenges

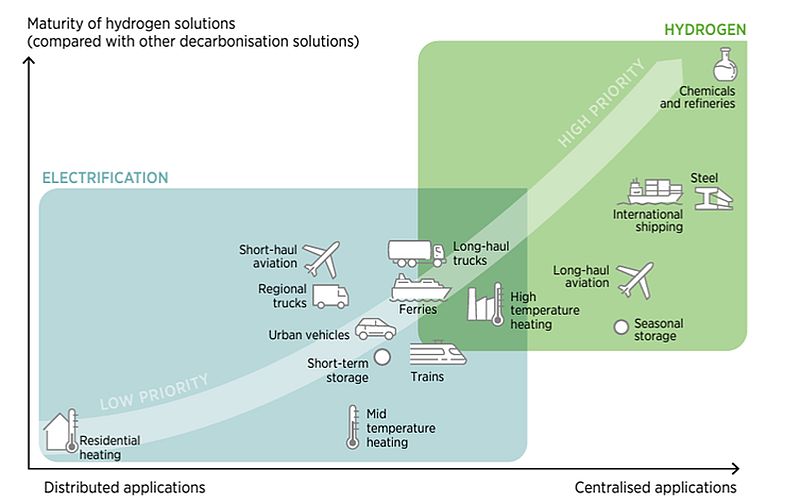

Numerous challenges confront the widespread adoption of renewable energy, including intermittency in power generation and the disparity between energy availability and population centres. A diverse range of solutions can address these demands: green hydrogen, carbon capture and storage (CCS), energy storage, upgraded transmission systems and innovations in power and demand control.

The transformative impact of emerging technologies on the zero-carbon transition remains uncertain.

Transitioning to a net zero-carbon world necessitates transporting vast amounts of renewable energy. High-voltage direct-current (HVDC) lines will help, but as distances grow, other transport modes become essential. Converting electricity to carriers such as hydrogen, ammonia or methanol becomes crucial. Managing data and information technologies will ensure stability, while demand-side management aligns energy supply and demand. Storage solutions play a pivotal role in resolving intermittency issues.

In addition to these technical matters, economic, social and environmental aspects need to be considered as well. The situation differs from country to country, requiring specific approaches. That is why experts across the world need to cooperate and exchange information and insights.

Key challenges to the energy transition, and beyond

- More than 95 % of the effort must come from stopping emissions, while carbon removal technologies or negative-emission technologies should only be used for the very few last per cent.

- There is a strong worldwide need for green molecules (both bio- and e-based,), but increasing energy efficiency and electrifying everything possible (far beyond cars) need to be prioritised.

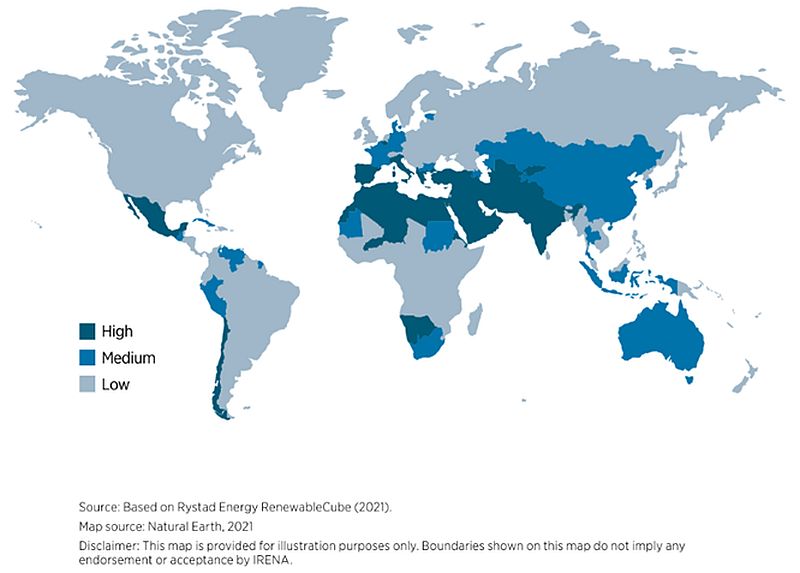

- The transition to green technologies extends beyond CO2, as water is emerging as a critical resource in the 21st Century. The green hydrogen and e-fuels economy will demand significant volumes of clean water, particularly in areas such as Oman, Spain, Chile and Australia, where large amounts of green hydrogen production are planned. About 70% of the planned electrolyser projects will be in water-stressed regions. Producing 1 kilogram of hydrogen necessitates 9 kilograms of pure, clean water, posing challenges in sourcing water at these locations.

Looking at the worldwide heat map of water stress levels, the catch is that sunnier locations (where cheap solar electricity is available for electrolysis) also tend to be the driest. Consequently, more than 85% of the envisioned green hydrogen initiatives might require obtaining water through desalination. This process could potentially increase the cost of producing a kilogram of hydrogen by 0.02–0.05 USD.

- Yet another challenge pertains to the availability of materials crucial for the energy transition. Questions arise about the availability of (rare earth) materials, their ethical and sustainable sourcing, and the risks associated with dependency on specific countries for these resources. Embracing a methodology akin to energy efficiency, focusing on material efficiency becomes vital. This involves R&D trajectories focused on using fewer materials to achieve similar performance, as seen in the reduction of silver usage in solar panels for example, or choosing technologies with less performance or efficiency, including abandoning certain materials. Grid storage batteries for instance could adopt alternative non-lithium technologies (such as zinc-bromide, iron-flow, or redox-flow batteries) that are less abundant and more sustainable. However, this shift might result in diminished round-trip efficiency performance.

Innovation on nuclear concepts

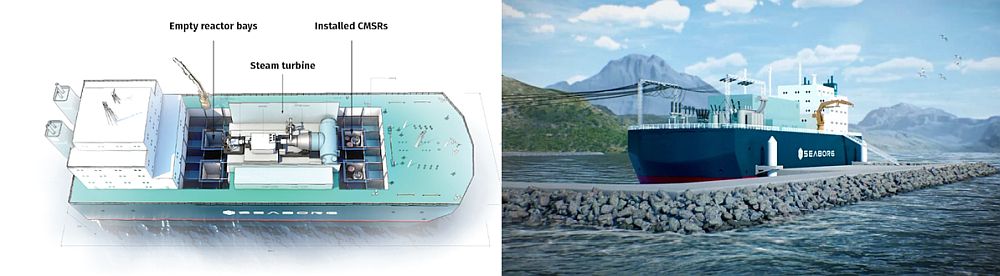

New nuclear concepts to provide baseload power were presented at the ‘start-up insights APEC session’. Denmark-based Seaborg presented its CMSR (Compact Molten Salt Reactor) floating power barge concept. It is developing a 250 MWt /100 Mwe CMSR with a liquid moderator for use in modular floating nuclear “power barges”. The company takes part in ENGIE Factory APAC, an initiative set up by Engie specifically focusing on the Asia-Pacific (APAC) region. ENGIE Factory serves as a platform that supports and promotes innovation in the energy sector. It acts as an incubator and accelerator for startups and innovative projects related to sustainable energy, smart cities, clean technology and various other facets of the energy transition.

A first prototype is expected in 2028 and will be built in South-Korea. Seaborg’s solution could solve the ‘not in my backyard’ issue, by installing these nuclear energy assets in harbour locations. For a country like Singapore, which is a renewable energy disadvantaged country, such solutions could provide baseload power if nuclear safety can be ensured. Indonesia also has signed a MOU with the company for collaborations.

AI for energy, or energy for AI?

There is a growing need for digital infrastructure (in general, new data centres) in the APAC region linked to the current (generative) AI trend. The cloud computing power needs for AI-based topics (such as ChatGPT) double every two months in general, according to Frost & Sullivan. This is a huge evolution and becomes a large issue in respect to power, cooling and water needs.

Singapore has emerged as a burgeoning hub for specialised cloud service providers establishing data centres in the region. 15 % of the revenue of Nvidia quarter end in October came from Singapore alone. Since January 2022, Singapore boasted more than 70 operational data centres, representing approximately 60 % of Southeast Asia's total data centre capacity. Globally, Singapore ranked third and stood first in the Asia Pacific region in terms of data centre market rankings. These data infrastructures require large amounts of electricity and cooling power, adding extra stress to the power grid. The operational data centres in Singapore have a footprint of more than 378 MW, which is over 7 % of Singapore’s electricity. Where typical data centres in the past were sized at 1 MW, nowadays the trend is to have 20 MW data units. The current AI trend is pushing the size of data centres towards even larger 200 MW units.

One can critically question how this trend will affect the current energy transition efforts and its technological pathways in finding solutions. Certainly knowing that a single GPT query consumes 15 times more energy than a Google search, and ChatGPT gulps 500 millilitres of water for every 10 to 50 execution prompts, depending on when and where the chatbot is used. Linking this fact to the energy and water scarcity topic mentioned above, this will mean that certain countries need to rethink their energy transition pathways. Singapore already has some regulation in place: permission can be given for a maximum of 60 MW of new capacity builds per year, and new data centres need to have a power usage effectiveness (PUE) of 1.3 or below (the lower the PUE number, the more efficient the data centre). Countries such as Malaysia and Indonesia are benefitting now for new data centre investments. Of course, decarbonisation of their energy mix is also a burning topic.

Underwater data centres

The offshore sector is experiencing growth due to lack of onshore space in certain countries, increasingly stringent regulations and the impact of climate change. This evolution is transitioning from isolated offshore activities to an integrated ‘offshore economy’. Linking this topic to the previous topics of the growing need for data centres, while attending the IERE conference, the same week China sank its first commercial, 1300 ton underwater data centre unit 35 meters in the sea nestled off the coast of Sanya, Hainan province. The entire project is composed of 100 such units.

Deploying data centres underwater offers numerous advantages. By utilising seawater for cooling, these centres reduce the need for energy-intensive air conditioning, thus lowering electricity costs. It is claimed by the project owner that the underwater data centre, once completed, will be 40-60 % more power efficient than centres hosted ashore.

Moreover, situating data centres in the sea maximises the use of the expansive seabed, cutting down on land expenses. Their remote location,, away from human settlements results in minimal external disruptions. The underwater setting boasts a lack of dust and oxygen, contributing to the prolonged durability and reduced susceptibility of electronic devices to malfunctions. Some of these underwater data centres will be strategically placed near coastal cities, enhancing proximity to the core nodes of the network and consequently improving network responsiveness.

While companies such as Microsoft have successfully trialled underwater data centres and validated their feasibility, China's iteration is set to enter commercial operation, catering to real customers.

Humidity

High humidity levels in South-East Asia are a challenge for energy storage systems and power electronics in general, which are commonly used in all kinds of technologies linked to the energy transition. Proper specification and validation testing before installations on-site are preferred. This topic was also highlighted in the presentation of Sirris at the conference (which we will discuss in a next article).

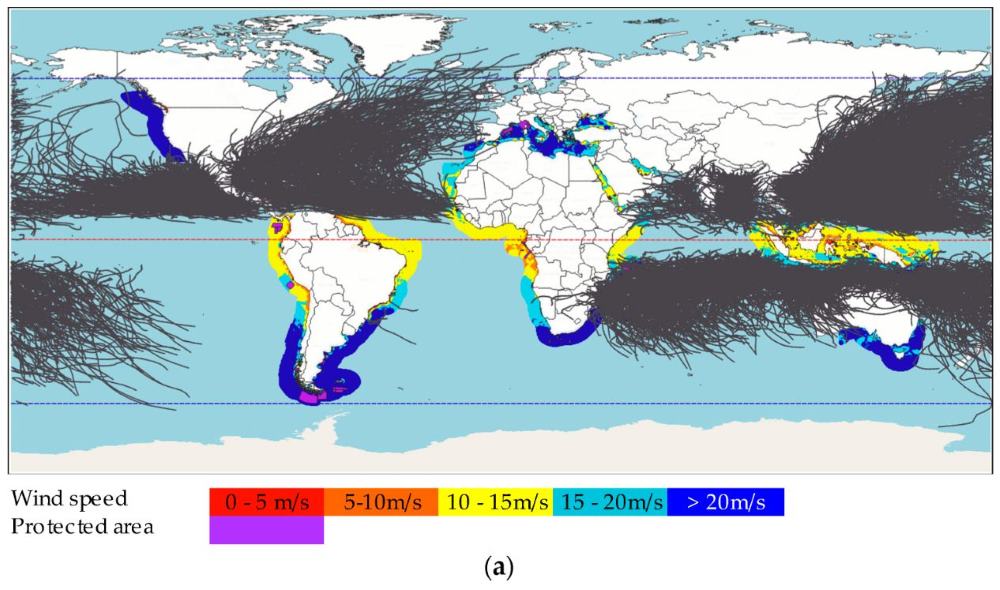

Offshore floating systems

Offshore floating solar systems have potential on calmer seas. Floating solar farms deployed near the equator hold the potential to energise future, densely populated areas. In tranquil offshore settings, these floating solar arrays could be an interesting renewable energy source. Specifically, regions with wave heights under 6 m and wind speeds below 15 m per second could yield up to 1 million TWh annually through offshore floating photovoltaic (PV) systems. The prime locations for such endeavours predominantly exist near the equator, particularly in Indonesia, Singapore, Malaysia and tropical West Africa. Indonesia boasts approximately 140,000 km² of marine areas that have maintained wave heights below 4 m and winds weaker than 10 m per second over the past four decades. This expanse presents an opportunity to generate around 35,000 TWh of solar energy each year, akin to the current global electricity production of 30,000 TWh annually. Indonesia could also transport electricity to neighbouring countries such as Singapore to fulfil their energy transition needs.

Contrary to most oceanic regions susceptible to storms, equatorial zones feature a mild maritime environment, obviating the necessity for extensive and costly engineering structures to safeguard offshore floating solar panels. Demonstration projects are starting up in the regio to evaluate the technical and economic potential.

Dutch start-up SolarDuck for example is partnering up in a 780 kWp offshore solar venture in Malaysia. A demonstration plant situated off the coast of Tioaman Island will be set up in 2025, aiming to evaluate the technical and economic viability of similar projects in the country. Notably, this project involves also a Belgian connection, incorporating the delivery of aluminium profiles from Hydro Extrusion Norway’s facilities in Lichtervelde, Belgium.

A ‘Floating Living Lab’ starting operations in the first quarter of 2024 is Singapore’s first energy storage system (ESS) on water. It could provide a future answer to a small island’s needs for energy storage from renewable sources and could help Singapore overcome land constraints.

A groundbreaking floating power plant, equipped with batteries, capable of refuelling liquefied natural gas (LNG) vessels, charging electric harbour craft, and supplying electricity to remote islands, will commence operations soon. This innovative energy storage system setup is a pivotal element within an integrated floating energy solution designed to address Singapore's land limitations, boasting a deployment footprint up to 40 % smaller than land-based ESS setups. The installation features a 7.5 MW/7.5 MWh battery energy storage system (BESS) on the Floating Living Lab, a barge serving as a platform to trial various marine energy applications. The project, backed by funding from the Energy Market Authority (EMA), aims to explore diverse marine energy functionalities. The ESS serves as a large-scale battery, storing surplus energy during off-peak periods and releasing it during high-demand phases. Its swift responsiveness enables active management of electricity supply and demand discrepancies, regulating instantaneous fluctuations in the power grid. Consequently, the ESS effectively handles the intermittent nature of solar power, which varies throughout the day due to Singapore's tropical climate, impacted by rain and cloud cover.

The floating system also incorporates LNG bunkering facilities catering to harbour craft and small vessels, alongside infrastructure for testing the charging of fully electric vessels. This comprehensive setup marks a significant step towards sustainable and adaptable energy solutions within maritime environments.

You can find more information on Seatrium’s Floating Living Lab on the following webpage.

This year, Sirris, in partnership with VIL, will also develop a floating battery concept in a new R&D project, as a more flexible alternative than fixed shore-power, to charge in-land vessels.

Sirris helps Belgian companies translate these global trends and insights into the creation of concrete roadmaps and feasibility studies for new products and processes. Want to know how we can help you? Check out our expertise and offering in renewable energy technologies.