In this series of blogposts we unravel the circular economy, connecting theory with practical examples and best practices. We use Walter Stahel’s book ‘The Circular Economy: A User’s Guide’ to dig deeper into key insights and link them to real-world examples and cases.

Finding out the influence and decision power of the different actors in the circular value chain, is essential to disclose value. Understanding the liabilities of those involved stakeholders will bring the key actors on the radar and lead you to your next step in your circular journey.

The manufacturer owns the design

It is easy to understand that the liability you have as a manufacturer directs the decisions in product design, manufacturing, distribution,… For instance, as a manufacturer you are responsible for the safe functionality of the products you bring to market. Therefore, you perform a risk analysis and implement prevention or mitigation actions that make sure your product complies with regulations and, above all, your customer enjoys trouble-free product use. In other words, it is you as a designer manufacturer who decides on the product specifications and its quality at the moment of sale. On the other hand, you might welcome some input from the customers and other stakeholders that can be used for (new) product development. Probably one of the most valuable design inputs is from the customer’s expectations, their behaviour in relation to your product, their product use profile, … In fact, you really want to know why the customer stops using your product. But for sure at the end, you as a manufacturer define how you translate this information into the final product specification and how you bring the product to market. The manufacturer owns the design.

The owner decides

The same logic applies for the owner of the product. It is the owner of the product that decides (often informally) if and how a product is used. It is the owner who decides to maintain the products, to repair the product, upgrade the product, refurbish the product, remanufacture the product. Even more, the owner decides if and when the product will receive a second life or when it is discarded as waste. This decision power of the owner is his liability. You as a designer manufacturer can provide some insights and recommendations, but in the end the owner decides. Only during warranty period the manufacturers influence might be more stringent.

One might think that the manufacturer is still needed for spare parts, for maintenance or upgrades. This is is not always the case as we will explain further on.

This means that product owners, like fleet managers, are in the lead, while service companies (maintenance companies, facility management,…) compete with the manufacturing companies to capture the value from the service-life of the products.

The moment of ownership transfer is as a result also a transfer of liability and thus a transfer of decision power.

Needless to mention is that keeping a close relationship with the product owner (and/or user) is a prerequisite to unlock the product servicing value. This reasoning is one of the basics why a 'Product as a Service' can be powerful as a value capturing approach. By keeping the liability at the manufacturer, the product service life is also controlled by the manufacturer. In this context the word ‘liability’ is key, since the practice of financing Products as a Service might split the ownership from the liability. A leasing company can become owner of a product (for the duration of the service contract), while the manufacturer keeps the liability of the service provided to the products at the customer.

Example: In some Light-as-a-Service models the armatures (products) are owned by a leasing company for the contracting period, while the light output (service) is the liability of the manufacturer through maintenance, controls, upgrades,….

Welcome to the real world

In many cases, especially in B2B, it is often far more complex. The owner is not necessarily the user of the product and liabilities might shift over time, based on the contractual agreements between all kind of stakeholders.

An example: manufactured HVAC equipment, such as a chiller or ventilation equipment, can be owned by the building owner, while installation is done by a service provider. The maintenance and health and safety inspections are through a contract and thus for a defined period of time assigned to a facility management company who orders service operation from yet another service provider, while the user might rent only a part of the building. Finally, the persons enjoying the HVAC functionality might not belong to any of the organisations mentioned above, instead they might be customers, visitors,… In most cases the picture is complex and needs some in-depth analysis to find out all the liabilities over time.

Tip: Check out where on the ranking you, as a manufacturer, are when the customer/user has needs related to the product that you provided. Maybe you are not in the customer's top three at the moment a service is required. A good starting point is to estimate the risks to the other actors in the network. What can you provide, besides products and services, such as knowledge, data, access to resources, …, that reduce those risks, while extending the entire product service-life?

Embrace this complexity that entered the business. It has as a major advantage that it can reduce the business risks. From a circular perspective it means that the interlinked elements can become a more resilient network. If one stakeholder fails to provide its product or service, there is more chance to find alternative solutions.

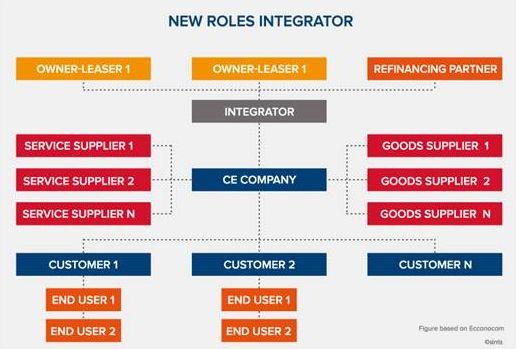

Additionally, value might be hidden in the complexity. Since most of us like simplicity, we tend to export the associated complexity to other partners. In the real world we need additional roles when introducing Product as a Service, since it is known as a complex system. One of the suggestions presented in Econocom’s publication for Circular Flanders 'Financiering van de circulaire economie' (in Dutch) is the role of an integrator. The figure below is an attempt to define and relate the necessary actors. Referring to the HVAC example the upcoming concepts such as design-build-maintain try to reduce the complexity, while assuring quality and clear responsibilities. The need for such new roles might be an opportunity for some of you.

Tip: How would you position the actors for your circular project? What are the liabilities and what is missing to make it a working system? Finding a common goal with your partners to maximise the value while reducing risks is a good and proven strategy to work to.

Case: TVH is a one-stop shop for material handling with equipment renting, spare parts distribution, refurbishing spare parts distribution, service providing, … Its broad set of activities illustrates the role the company plays as a manufacturer in the value chain after the sales of an OEM took place. Some OEMs rely on this company to provide the required spare part on time to their customers and can offer additional services. Over time they took over liabilities (in part availability and delivery) from the OEMs.

Owning at end-of-use

When a product becomes waste, another ownership and liability transfer takes place. Multiple cascading processes might exist. A product might be discarded by the owner while the new owner might decide to reuse repurpose the product or parts of the product. While coming closer to the material itself remaining value decreases. One strategy to deal with this value decrease is to keep the ownership and liability as high as possible in the value chain. You as manufacturer or service provider might be interested in keeping the liability in close collaboration with the fleet owner or the user. For you as a manufacturer (or as a potentially new owner) the product might have more value than waste. Often, this value is found in some of its components, rather than in the product as a whole.

Tip: Get involved in second-hand sales for your product. As a manufacturer, you have the knowledge and competences to inspect and evaluate the status of a returned product. Based on this evaluation, you can define the price and the potential warranty or guarantee you provide.

Case: Aerocircular is a company that dismantles end-of-life airplanes. They closely collaborate with the fleet owner. They provide the service of dismantling and optimal valorisation. By splitting the income from the part sales, materials, … both parties have an interest in striving to maximise this process. This is why they continuously seek better applications for the end-of-life parts (panels, seats, …) and materials (stainless steel, aluminium, …).

Conclusion

One of the key insights for a manufacturing company taking steps towards circular economy is to get in-depth knowledge on how the liabilities currently change over the product life time. Having this insight will enable you to detect how this value can be disclosed in each life cycle: during product use by the owner and/or user, at the end of (first) life or at the final disposal of the product.

If you want to upgrade your CE offerings, it is essential to invest in good customer relations. Staying in contact by creating and using communication lines is key.

The above tips will be integrated in a tool allowing companies to score their circularity. Stay tuned and be the first to be informed when we launch this tool!

Want to know more or discuss your circular business idea? Let us know and we will share with you all our information and our network to bring the circular economy another step closer.

]]>