Participants confirm: manufacturing industry does have a future in Belgium!

All sorts of (doom) scenarios about the future of the manufacturing industry are popping up around us. At Manufacturing Day, on 23 November 2023, we aimed to separate fact from fiction, together with the attending manufacturing companies. During an interactive session, participants were presented with five questions and statements, which prompted an engaging discussion.

Manufacturing companies wanting to remain competitive, need to transform their production. To provide these companies with an insight into the latest technology trends and their impact on lead time, variety, quality and costs, Sirris organised Manufacturing Day 2023 on 23 November. The day featured practical demonstrations and enlightening testimonies by manufacturing companies on successful manufacturing innovations, as well as an interactive session, in which five questions and statements were presented to the audience using Mentimeter.

The interactive session was led by Ben Van Roose, Manager Manufacturing at Agoria and Bart Verlinden, Manager 4.0 Made Real at Sirris.

1. Potentially a better location than Belgium for lower-cost production, more value for customers and more effective innovation?

Results: The answers reveal that many companies (31) want to stay in Belgium, followed at a distance by Poland (10), Germany (4), the Netherlands (3) and China (3). This was quite a surprising, albeit hopeful result: manufacturing companies believe there is still a future for production in our country, locally, despite our wage handicap.

Poland scores high, mainly thanks to lower wages and the fact that there is still talent around, although wages for technical profiles are also rising there. This situation is likely not permanent.

Germany was chosen because of its solid industrial network and strong cooperation between research institutions and industry, while the Netherlands has to rely on its typical entrepreneurial climate of wanting to take the bull by the horns and no-nonsense mentality.

Yet the majority of attendees want to continue producing in Belgium. However, we should continue to invest in our manufacturing industry to structurally anchor it here. This requires a very strong commitment to talent development, to ensure that we have the right people to create quality personalised products.

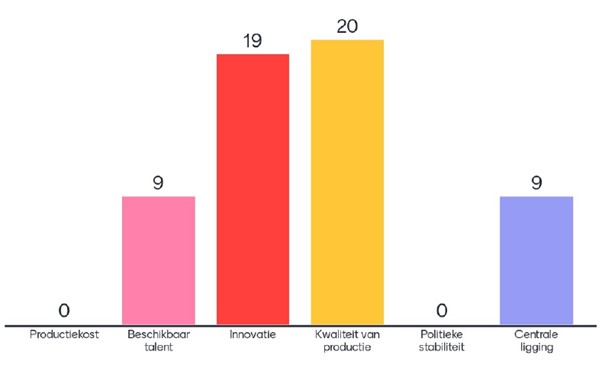

2. What is the absolute strength of a Belgian manufacturing company?

Quality of production received the highest score and is indeed a key differentiator for our manufacturing industry. Yet, we should not be too complacent, as other countries and regions are also making strides in terms of quality, even countries like China and India.

Innovation emerges in several studies as a key asset for our manufacturing industry. Indeed, we have a lot of global players around here with an innovative product range. It is important to continuously innovate production too, so that these products can be produced efficiently. The advantage is that the big players bring a whole network of smaller companies and 'force' them to innovate as well, so to speak. Moreover, from the government's point of view, continued efforts should be made to encourage innovation for the manufacturing industry.

Available talent scores surprisingly high, as almost all companies indicate that finding suitable technical staff is a challenge. A 'war on talent' is very clearly going on, and not only for Belgian workers, but also for international profiles. Lots of initiatives are starting to convince young people to choose technical professions, but also to teach workers new skills ('upskilling'). These new skills will indeed be needed, given the increasing automation and digitisation of production.

3. How do you estimate the ratio of robots per worker in China and Belgium?

Most votes went to 1.5 more in Belgium. Surprisingly, the correct answer turned out to be ‘1.5 times more in China’, admittedly the second highest score among participants.

It is a fact than 75 per cent of Belgian manufacturing companies still have automation potential. This seems particularly high, but can be explained: when it comes to automation, many companies still think of fully robotised production lines. In mass production, this type of automation can be economically justifiable; in fact, China still focuses mainly on cost-efficient mass production. In a high-mix-low-volume context, however, this classic automation makes less sense. Yet there is still a lot of potential for automation, but in a different way.

Obviously, several drivers for automation exist - cost, quality, speed - but in recent years we have noticed an increasing demand and interest in using automation to support and take away workload from operators. After all, many manufacturing companies are struggling to find suitable (technical) staff. Therefore, these profiles should perform predominantly value-added tasks. Boring, repetitive, hazardous tasks should ideally be automated. Flexible automation solutions, such as cobots, which take over certain tasks, or autonomous mobile robots, which reduce searching and walking, can add value here. This targeted automation makes sense and often the payback periods are relatively short. Many manufacturing companies have not yet sufficiently explored these options, resulting in the high number of 75 per cent.

4. Forget Industry 4.0, Industry 6.0 is 'the way to go'!

The answers revealed that companies are not concerned about the terminology used and many have never even heard of 'Industry 6.0'.

From this, we derived the following proposition: 'The problem to be solved' is much more important than 'the technology used'.

Does that meant that companies have reached the point of saturation for buzz words? This is indeed true. When people talk about Industry 5.0, and even Industry 6.0 (quantum computing, metaverse), they wrongly give the impression that Industry 4.0 is actually already obsolete, which is obviously not the case. Many seem to forget that Industry 4.0 was born in Germany, at the time as a vision for the manufacturing industry by 2030, and we are not that far yet.

Moreover, if we look at the Acatech maturity model - which is still in use as a reference - most companies are at stage 2 or 3 ('transparent factory') in terms of maturity in Industry 4.0, while the leading companies are at stage 5. Son there is still room for significant progress. What does not help, of course, is the tsunami of buzz words and technologies, and the often exaggerated claims about the impact of these technologies. The technology push has caused us to drift away from the essentials: digitalisation is a means and not an end. The problem to be solved should always be the focus.

Therefore, it’s important to present the impact/ROI of a technology in an honest and realistic way, while also paying adequate attention to potential pitfalls. Fortunately, there are plenty of realistic examples showing that digitisation of production or support processes can indeed add value. The cases presented at Manufacturing Day 2023 will certainly help in this regard. So no, Industry 4.0 is not dead yet.

5. Have you ever used ChatGPT for an application in production?

Most attendees (28) replied that ‘no, they haven’t’, although a few (15) had already taken a first step and a few companies (6) even use the tool on a daily basis.

To what extent is this consistent with the statement ‘A manufacturing company not investing in AI now, is too late’, or can the question 'to AI or not to AI' be answered? We can't ignore it: a lot is going on in relation to AI today. For some cases, however, this is more a sort of 'window-dressing', where the term 'AI' is used mainly because it sounds sexy. On the other hand, we find that in certain sectors such as IT, finance, healthcare, retail ... several concrete applications are already in use without the added value being questioned.

The situation for the manufacturing sector is somewhat different. Many companies are wondering how AI can help increase productivity or competitiveness. Not infrequently, ChatGPT pops up as the most famous example, immediately followed by ‘this is not for us’. During a recent survey of the manufacturing industry, more than 80 per cent of the surveyed manufacturing companies explicitly stated that they see AI as a distant reality. However, when they outline their ideal picture of the future (from a manufacturing point of view), it turns out that almost all scenarios contain an AI component (e.g. automatic quote generation, automatic production planning, machines that set themselves, vision combined with robotisation, ...). It will therefore be important to make the options of AI concrete from the point of view of manufacturing companies and, again, start from 'the problem to be solved'. This is much more valuable than giving all kinds of futuristic examples.

By the way, we can say that there are examples in Belgium of companies which are applying AI in the manufacturing industry, and with great results. So, it really is coming in the future, but it is not too late now if a company has not yet made the move. However, it is important now to pay sufficient attention to cyber-security and other privacy issues during the rollout. This is no longer a distant reality at all, quite the contrary.

Want to know more about these Interactive sessions? Contact us!